While other methods like relative valuation are fairly easier to calculate, their reliability becomes questionable when the entire sector or market is over-valued or under-valued.

FREE PROPERTY EVALUATOR CASH FLOW DRIVERS

Irrespective of whether a cash outlay is categorized as an operating expense in P&L, or capitalized into an asset on balance sheet, FCF is a true measure of the money left over for investors.īesides explicitly considering the business drivers involved, DCF allows investors to incorporate key changes in the business strategy in the valuation model, which otherwise will go unreflected in other valuation models (like relative, APV, etc.)

FREE PROPERTY EVALUATOR CASH FLOW FREE

To a larger extent, Free Cash Flows (FCF) are a reliable measure that eliminate the subjective accounting policies and window dressing involved in reported earnings. Unlike other valuations, DCF relies on Free Cash Flows. Consequently, this comes closest to estimating intrinsic value of the asset/business.

Given its increasing significance in business valuations, let’s look at some of the key advantages and disadvantages associated with DCF Valuation: AdvantagesĭCF Valuation truly captures the underlying fundamental drivers of a business (cost of equity, weighted average cost of capital, growth rate, re-investment rate, etc.). The farther we depart from this idealized setting, the more difficult and less reliable DCF Valuation will be. whose cashflows are currently positive and can be forecasted with some reliability, and where a proxy for risk that can be used to obtain discount rates is available.

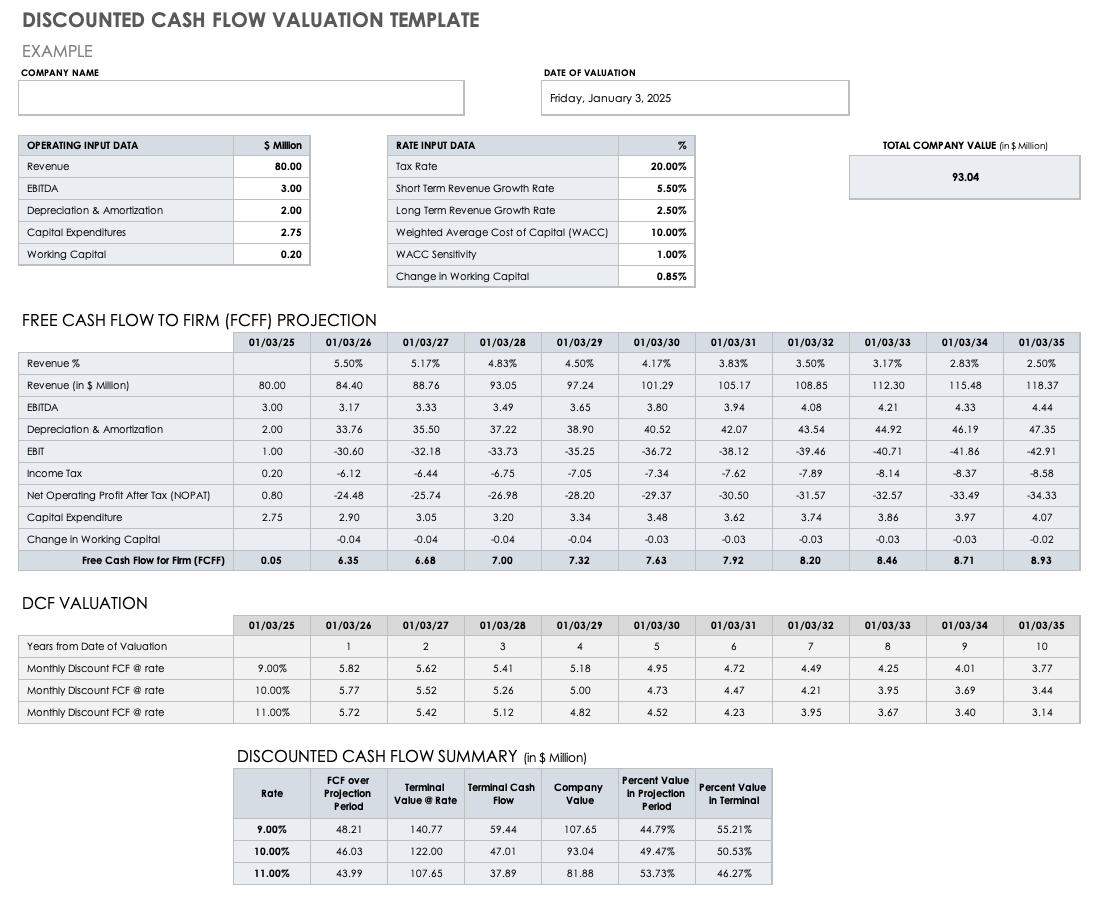

Given these mandatory requirements to arrive at DCF Valuation, this approach is easiest to use for assets, businesses, etc. Anyone who understands DCF technique will be able to analyze and apply all other valuation methodologies, thus underlying the importance of DCF Valuation.ĭiscounted Cash Flow Valuation is based upon expected future cash flows of the company and its associated discount rate, which is a measure of the risk attached to the business in general and company in particular. Similarly, to apply option pricing modelling techniques, we often need to begin with a discounted cashflow valuation. To perform Relative Valuation correctly, we need to understand the fundamentals of DFC Valuation. DCF Valuation is the basic foundation upon which all other valuation methodologies are built. Intrinsic Value of a business is the present value of the cash flows the company is expected to pay its shareholders. Discounted Cash Flow (DCF) Valuation estimates the intrinsic value of an asset/business based upon its fundamentals.

0 kommentar(er)

0 kommentar(er)